6 simple tips below, some of which will save you a lot of money immediately or in the long term, or which can bring you additional money.

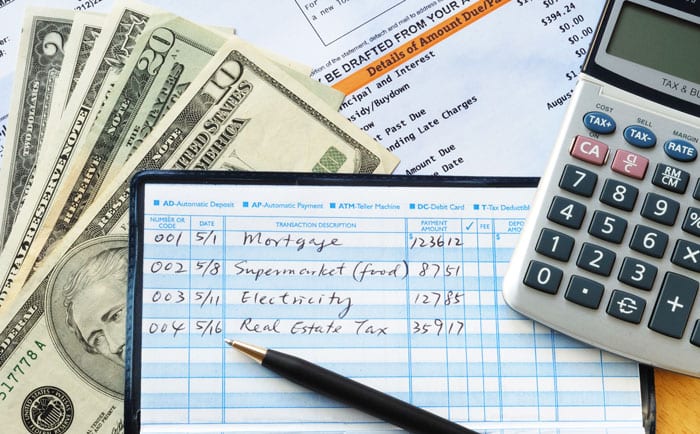

Keep a budget book

The first tip doesn't seem very interesting at first glance. Because how can you save money if you just write down your expenses?

It's simple: most people spend their money without keeping track of the expenses. If you write down and keep track of your monthly expenses, you are sure to find some things that can be saved without feeling constrained. It is worth it!

Look out for promotions and compare prices

Maybe you are already doing it, but most people go shopping spontaneously and by their instinct. But this is an expensive mistake. Anyone who buys spontaneously tends to make impulse purchases and these cost money. Take a look in advance to see what you would like to buy and where it is currently the cheapest.

Then write yourself a shopping list and only buy the things that are on the list. This is a very simple way of avoiding expensive impulse purchases.

Compare your contracts and insurance

We all have one or the other insurance, simply because it doesn't work without certain insurance such as health insurance. If you have private health insurance, you should definitely check your insurance regularly. Are the services needed at all, or does a higher franchise make sense?

Use loyalty cards and Co.

Loyalty card providers are a dime a dozen today, but at least some of the programs are sometimes very worthwhile. A customer card is particularly worthwhile for stores in which you shop regularly. You shop there anyway, so why not save at least a little?

Sell unused things

Whether in the apartment, in the basement or in the attic. We all have things that are still usable but are despised by us for whatever reasons. Sell them quickly and easily via the well-known portals on the Internet. Your wallet will be happy!

Take advantage of cashback programs

Similar to customer cards, cashback programs save you real cash when you make normal purchases. Some of the programs are included with some credit cards or can be used via certain websites. As a rule, you will be reimbursed between 2% and sometimes up to 15% of the purchase price at a later point in time. In the long run, this makes a nice amount!